Ellen contracts with James to be her stockbroker, making stock trades for Ellen's account. Ellen need not pre- approve the trades that James makes, only trades for more than $20,000 . Ellen and James include a clause stating "that in case of any disputes arising out of this contract; the dispute shall be arbitrated using the rules of the New York Stock Exchange." Ellen learns that since signing

her contract with James, he has routinely been making trades worth more than $20,000 without her permission, and losing money. After presenting her evidence at arbitration, Ellen is quite happy when they decide that, in fact, James has violated his contractual obligations to her, and owes her damages. Any damages that Ellen wins are known as:

a. an award b. a judgment c. an exaction

d. a presentation e. a collection

a

You might also like to view...

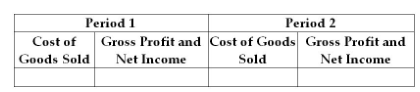

State the effects of inventory errors on cost of goods sold and net income for periods 1 and 2. The response should be overstated or understated.

Period 1 Ending Merchandise Inventory is overstated

Which of the following statements regarding vacation benefits is correct?

A) No entry is needed until the employee takes a paid vacation. B) The account, Vacation Expense is debited when the employee takes a paid vacation. C) Health and pension benefits are recorded in the same manner as vacation benefits. D) When an employee takes a paid vacation, the account, Vacation Benefits Payable is credited.

A functional strategy is ______.

A. at a higher level than the department-level strategy B. at a lower level than the department-level strategy C. the same as the department-level strategy D. often referred to as a tactic

A marriage partner of a spouse with earned income and without a qualified retirement plan

A) may not have a spousal IRA unless he or she also has earned a minimal wage. B) may have a spousal IRA even if she or he had no earned income. C) may have a spousal IRA only if the market worker contributed less than $2,000 to his or her IRA. D) may not have an IRA if the working spouse already has one.