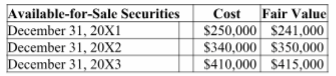

Carpark Services began operations in 20X1 and maintains long-term investments in available-for-sale securities. The year-end cost and fair values for its portfolio of these investments follow. The year-end adjusting entry to record the unrealized gain/loss at December 31, 20X2 is:

A) Debit Unrealized Gain – Equity $10,000; Credit Fair Value Adjustment – Available-for-Sale (LT) $10,000.

B) Debit Fair Value Adjustment – Available-for-Sale (LT) $19,000; Credit Unrealized Loss –Equity $9,000; Credit Unrealized Gain – Equity, $10,000.

C) Debit Fair Value Adjustment – Available-for-Sale (LT) $10,000; Credit Unrealized Gain –Equity, $10,000.

D) Debit Fair Value Adjustment – Available-for-Sale (LT) $10,000; Credit Unrealized Loss –Equity $10,000.

E) Debit Fair Value Adjustment – Available-for-Sale (LT) $19,000; Credit Unrealized Gain –Equity $19,000.

B) Debit Fair Value Adjustment – Available-for-Sale (LT) $19,000; Credit Unrealized Loss –Equity $9,000; Credit Unrealized Gain – Equity, $10,000.

You might also like to view...

If bonds are issued at a premium, the amortization of the premium over the life of the bonds causes the

a. interest expense to increase; b. interest payment to decrease; c. carrying value of the bonds to decrease; d. liability account to increase; e. maturity value to decrease.

You must add one of two investments to an already well- diversified portfolio

Security A Security B Expected Return = 14% Expected Return = 14% Standard Deviation of Standard Deviation of Returns = 15.8% Returns = 19.7% Beta = 1.8 Beta = 1.5 If you are a risk-averse investor, which one is the better choice? A) Security A B) Security B C) Either security would be acceptable. D) Cannot be determined with information given

Caspion Corporation makes and sells a product called a Miniwarp. One Miniwarp requires 2.5 kilograms of the raw material Jurislon. Budgeted production of Miniwarps for the next five months is as follows: August22,600unitsSeptember21,300unitsOctober22,700unitsNovember23,900unitsDecember23,600unitsThe company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 10,800 kilograms of Jurislon were on hand. The cost of Jurislon is $18.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.The total cost of Jurislon to be purchased in August is:

A. $1,839,600 B. $1,017,000 C. $1,208,700 D. $1,014,300

Record the following transactions on the books of St. Marie's Hospital, a private not-for-profit hospital. (a)The Hospital billed patients $612,000 for services rendered. Of this amount, 5% is expected to be uncollectible. Contractual adjustments with insurance companies are expected to total $87,000. (b)The Hospital received $750,000 in pledges of support in a campaign undertaken to purchase new MRI equipment. All of the pledges are payable within one year and 8% are expected to be uncollectible.(c)Charity care in the amount of $36,000 (at standard charges) was performed on an indigent patient.(d)The Hospital collected $487,200 for the services performed in (1) above. Actual contractual adjustments for these services amounted to $89,700. $ 13,700 of receivables were

identified as uncollectible and written off. What will be an ideal response?