Which of the following is the most likely result of financial intermediaries?

A) increased funds available to borrowers

B) higher transaction costs

C) higher information costs

D) lower information cost but higher transaction costs

A

You might also like to view...

Moody's Investors Service is able to make a profit because

A) most investors are irrational. B) of the existence of adverse selection problems. C) fluctuations in interest rates make default risk on corporate bonds difficult to gauge. D) small investors like the mutual funds they sell.

Which of the following statements is FALSE?

A) Both monetary and interest rate targets cannot be pursued simultaneously. B) A reduction in the required reserve ratio increases the money supply and pushes down the equilibrium interest rate. C) An open market purchase reduces the money supply and pushes down the equilibrium interest rate. D) An open market sale decreases the money supply and pushes up the equilibrium interest rate.

What are the effects of an increase in the minimum wage? Who would be most affected?

What will be an ideal response?

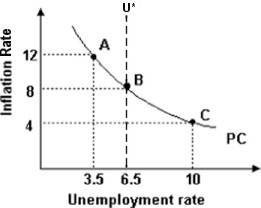

Refer to the above figure. Suppose the economy is at point B and the central bank adopts contractionary monetary policy. In the short run, this will result in

Refer to the above figure. Suppose the economy is at point B and the central bank adopts contractionary monetary policy. In the short run, this will result in

A. the economy moving towards point A. B. the economy staying at point B. C. the economy moving towards point C. D. an outcome that cannot be predicted, because not enough information is given.