If the U.S. government decided to pay off the national debt by creating money, what would be the most likely effect?

A. A substantial reduction in real GDP

B. A deflationary collapse

C. Rapid inflation

D. An increase in the trade surplus

Answer: C

You might also like to view...

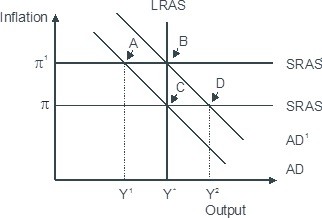

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

Concerning an investment project which of the following is TRUE?

A) A risk-neutral individual is more likely to invest than a risk-averse individual. B) A risk-neutral individual is more likely to invest than a risk-loving individual. C) A risk-neutral individual is less likely to invest than a risk-averse individual. D) Not enough information is given.

Suppose pigs (P) can be fed corn-based feed (C) or soybean-based feed (S) such that the production function is P = 2C + 5S. If the price of corn feed is $4 and the price of soybean feed is $5, what is the cost-minimizing feed combination producing P = 200?

a. C = 100 b. S = 40 c. C = 50, S = 20 d. C = 20, S = 50

When a customer deposits $1,000 in a bank, the deposit is: a. an asset of the Federal Reserve

b. included in M1 if it is currently in a commercial bank's vault. c. a liability to the customer. d. an asset to a commercial bank if it is currently in the bank's vault. e. a liability for the bank as the bank owes it to the customer.