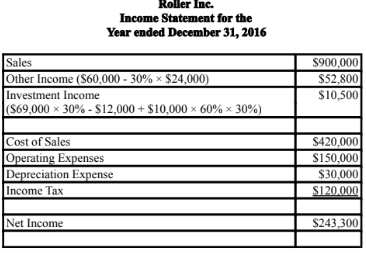

Prepare Roller Inc's 2016 income statement, assuming that Larmer is considered to be a joint venture and is reported using the equity method.

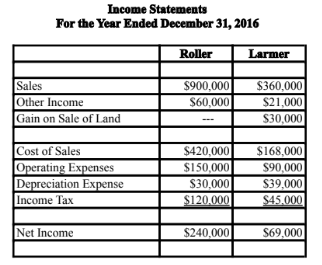

The following are the 2016 Income Statements of Roller Corp and Larmer Corp.

Other Information:

During 2016 Larmer paid dividends of $24,000. Roller acquired its 30% stake in

Larmer at a cost of $400,000 and uses the cost method to account for its

investment.

The acquisition differential amortization schedule showed the following write-off

for 2016:

During 2016, Larmer paid rent to Roller in the amount of $12,000, which Roller

has recorded as other income.

In 2015, Roller sold Land to Larmer and recorded a profit of $10,000 on the sale.

During 2016, Larmer sold the land to a third party.

Both companies are subject to a 40% tax rate.

You might also like to view...

What is the only difference between present value and future value?

What will be an ideal response?

If someone provides a taxpayer with either property or services, economic performance occurs when:

A. the taxpayer actually uses the property. B. the property or services are actually provided. C. the liability to pay for the property or services exists. D. the taxpayer pays the other person for the property or services.

Market research shows potential customers will buy a particular product at a selling price of $3,100 . If the desired profit is 28 percent of target cost, the company should make the product if the cost does not exceed

a. $3,100. b. $868. c. $2,232. d. $2,422.

Express contract can be stated orally

Indicate whether the statement is true or false