The long position in a futures contract is the party that will:

A. benefit from decreases in the price of the underlying asset.

B. accept the greater share of the risk.

C. agree to make delivery of a commodity or financial instrument at a future date.

D. benefit from increases in the price of the underlying asset.

Answer: D

You might also like to view...

Real GDP is the value of final goods and services produced in a year

A) expressed in the prices of that same year. B) during a recession. C) minus depreciation. D) expressed in the prices of a base year. E) minus the value of all the intermediate goods produced.

The relationship between money growth rates and inflation between 1982 and 2010 helps explain why, by the 1990s, most economists had

A. adopted the monetarist explanation of inflation. B. adopted a rules-only approach to monetary policy. C. become more convinced of the monetary causes of inflation. D. abandoned monetarism as the primary explanation of inflation.

Which is a possible solution to a divisional conflict regarding a decision?

a. change the division that has the authority to make the decision b. change the information flow so that the decision maker is better informed c. change the evaluation and reward scheme governing the decision maker d. all of the above

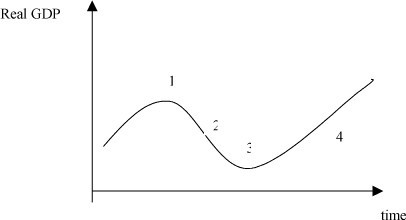

Refer the above figure. Stage "4" of the economy is called

Refer the above figure. Stage "4" of the economy is called

A. an expansion. B. a development. C. a maturity. D. a spreading out.