The_______relieves a manufacturer of liability for failing to warn of a product's characteristics or dangers when "the end user knows or reasonably should know of a product's dangers"

a. naïve user defense

b. smart user defense

c. intelligent user defense d. informed user defense

e. none of the other choices are correct

e

You might also like to view...

The first step in any marketing research project is to ________

A) define the problem B) develop an approach to the problem C) formulate the research design D) correct the problem E) excise the problem

Talia has asked her groupmates to meet at her home, which is a 30-minute drive from campus. The group members protest, and two of the five members don’t even show up to their meeting. What element has Talia likely failed to consider with regard to group meeting environment?

a. aesthetics b. location c. comfort d. time

Which of the following is an advantage of a proprietorship?

A. It makes it easy for the owner to obtain credit. B. It offers unique tax advantages. C. It provides access to unlimited capital. D. It continues to legally exist even after the proprietor's death.

Prepare a schedule of realized and unrealized profits for the fiscal year ended June 30, 2018 for both companies. Show your figures before and after tax.

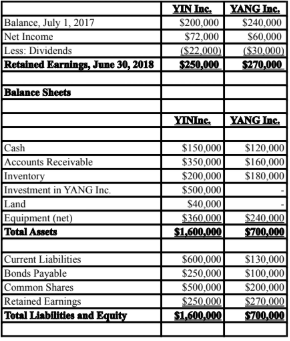

YIN Inc. purchased 75% of the voting shares of YANG Inc for $500,000 on July 1, 2015. On that date, YANG Inc.'s Common Shares and Retained Earnings were valued at $200,000 and $100,000 respectively. Unless otherwise stated, assume that YIN uses the cost method to account for its investment in YANG Inc.

YANG's fair values approximated its carrying values with the following exception:

YANG's bonds payable had a fair value which was $50,000 higher than their carrying value.

The bonds payable mature on July 1, 2025. Both companies use straight line amortization exclusively.

The Financial Statements of both companies for the Year ended June 30, 2018 are shown below:

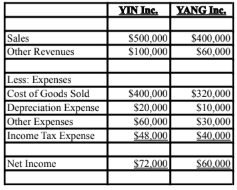

Income Statements

Retained Earnings Statements

Other Information:

During August of 2016, YIN sold $60,000 worth of Inventory to YANG, 80% of which was sold to outsiders during the year. During October of 2017, YIN sold inventory to YANG for $90,000. two-thirds of this inventory was resold by YANG to outside parties later that year.

During September of 2016, YANG sold $90,000 worth of inventory to YIN, 50% of which was sold to outsiders during the year. During April of 2018, Yang sold inventory to YIN for $120,000. 80% of this inventory was resold by YANG to outside parties in May.

During May of 2018, YANG sold a plot of Land to YIN for $40,000. The land was recorded at cost of $24,000 on YANG's book prior to the sale. YIN has not yet sold the land.

All intercompany sales as well as sales to outsiders are priced 50% above cost. The effective tax rate for bothcompanies is 40%.

What will be an ideal response?