For any given financial asset, risk levels and average expected rates of return are:

A. independent of each other.

B. negatively related because assets with higher average expected rates of return sell for

higher prices, which are inversely related to risk.

C. positively related because both are inversely related to the rate of inflation.

D. positively related because investors must be compensated for taking greater risks.

D. positively related because investors must be compensated for taking greater risks.

You might also like to view...

Briefly answer the following questions

(a) What is a foreign currency option? Is there any difference between a European and American option? (b) Why might you prefer an option over a futures or forward contract? (c) When can a gain be made by the holder of a call option? A put option?

Under the Exchange Rate Mechanism of the European Monetary System, when the German mark depreciated below its lower limit against the British pound, the Bank of England was required to buy ________ and sell ________,

thereby ________ international reserves. A) pounds; marks; losing B) pounds; marks; gaining C) marks; pounds; gaining D) marks; pounds; losing

If the United States has a trade deficit with China, then China must have

A) a trade surplus with countries other than the United States. B) a trade surplus with the United States. C) a trade deficit with countries other than the United States. D) a trade deficit with the United States.

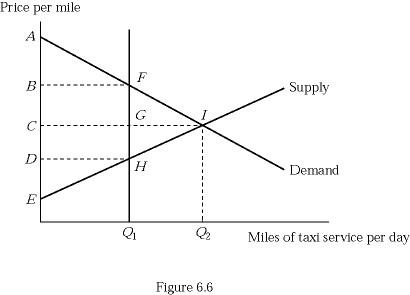

Refer to Figure 6.6, which shows a market for taxi medallions. If the number of taxi licenses is reduced from Q2 to Q1, the consumer surplus from consuming taxicab services is represented by:

Refer to Figure 6.6, which shows a market for taxi medallions. If the number of taxi licenses is reduced from Q2 to Q1, the consumer surplus from consuming taxicab services is represented by:

A. area ABF. B. area ACFG. C. area DEH. D. area BEFH.