Why is it difficult to determine whether a country is dumping? Explain fully

What will be an ideal response?

According to the WTO rules, dumping occurs when an exporter sells a product at a price below what it charges in its home market. It is not always possible to compare the home market and foreign market prices, however, and wholesalers, transportation costs, and other price add-ons may limit the comparison's usefulness. Two other measures may be used. Comparisons can be made between the price in the import market and either the price charged in third-country markets, or to an estimate of the cost of production. Comparison to prices in third-country markets is similar to that between prices in the exporter's home market and the importer's market, and it may be uninformative for the same reasons. A comparison of the import price and the estimated cost of production, including a normal rate of return on invested capital, assumes that production costs in an exporting country can be measured with accuracy. Thus it is difficult to determine when a country is dumping, and many elements of this determination are somewhat subjective.

You might also like to view...

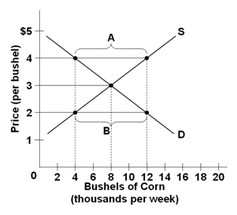

Use the following diagram for the corn market to answer the question below.  If the price in this market is fixed at $2 per bushel, then

If the price in this market is fixed at $2 per bushel, then

A. buyers will find too much corn in the market. B. buyers will be able to get as much corn as they wish to buy. C. sellers will not be able to sell all the corn that they intended to sell. D. sellers will quickly run out of corn that they bring to market.

Heteroskedasticity means that

A) homogeneity cannot be assumed automatically for the model. B) the variance of the error term is not constant. C) the observed units have different preferences. D) agents are not all rational.

In general, lower marginal tax rates provide incentives to

A. Produce more output. B. Work less. C. Find more tax loopholes. D. Invest less.

Which of the following best measures the household sector's contribution to the support of the public sector?

A. Government transfer payments. B. GDP minus depreciation. C. Corporate profits taxes plus undistributed corporate profits. D. The difference between personal income and disposable income.