The money multiplier:

A. Is equal to the required reserve ratio times transactions deposits.

B. Gets larger as the required reserve ratio increases.

C. Is the reciprocal of the required reserve ratio.

D. Represents the lending capacity of an individual bank.

C. Is the reciprocal of the required reserve ratio.

You might also like to view...

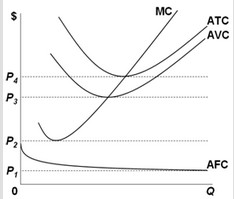

Use the following graph showing short-run cost curves for a perfectly competitive firm to answer the next question. At what price would the firm earn a normal profit and break even?

At what price would the firm earn a normal profit and break even?

A. P1 B. P2 C. P3 D. P4

Funds flow from lenders to borrowers

A) indirectly through financial markets. B) directly through financial intermediaries. C) indirectly through financial intermediaries. D) primarily through government agencies.

The marginal revenue product curve slopes downward only if the firm is a price searcher in the product market

a. True b. False

Because barriers to entry are low in competitive price-searcher markets, in the long run, a firm's price will be equal to

a. marginal revenue. b. average total cost. c. average variable cost. d. average fixed cost.