An example of a regressive tax is the

A) corporate income tax.

B) personal income tax.

C) Social Security tax.

D) state inheritance tax.

C

You might also like to view...

If a bank has $6,000 in checkable deposits and the required reserve ratio is 0.2, then the bank can lend: a. $4,000

b. $16,000. c. no more than $4,800. d. no less than $3,000. e. $1,000.

When a tax is regressive, as a person's income rises, the tax rate:

a. stays the same. b. decreases. c. increases. d. increase and then decreases. e. decreases and then increases.

If at an interest rate of 7 percent, planned investment is $2 trillion, government spending is $3 trillion, net taxes are $2.8 trillion, and household saving is $2.2 trillion, what is the quantity of funds demanded at an interest rate of 7 percent?

a. $1.8 trillion b. $2.2 trillion c. $2.8 trillion d. $5.0 trillion e. $5.8 trillion

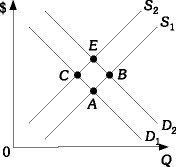

Refer to the information provided in Figure 3.16 below to answer the question(s) that follow. Figure 3.16Refer to Figure 3.16. When the economy moves from Point C to Point B, there has been

Figure 3.16Refer to Figure 3.16. When the economy moves from Point C to Point B, there has been

A. a decrease in demand and a decrease in supply. B. an increase in quantity demanded and an increase in quantity supplied. C. an increase in demand and a decrease in supply. D. an increase in demand and an increase in supply.