Using aggregate demand and aggregate supply, explain what happens in the short run if the Federal Reserve raises interest rates in the economy. Be sure to detail what happens to aggregate demand, the price level, the level of GDP, and unemployment

Assume that the economy is at full employment before the interest rate increase.

What will be an ideal response?

An increase in the interest rate will cause aggregate demand to decline. Interest costs are part of the cost of borrowing and as they rise, both firms and households will cut back on spending. This shifts the aggregate demand curve to the left. This lowers equilibrium GDP below potential GDP. As production falls for many firms, they begin to lay off workers, and unemployment rises. The declining demand also lowers the price level. The economy is in recession.

You might also like to view...

Consumer surplus is the:

a. amount by which the quantity supplied of a good exceeds the quantity demanded of a good. b. measure of consumes' willingness to buy a good plus the price of the good. c. measure of how much consumers value a good. d. amount consumers are willing to pay for a good minus the amount the consumers actually pays for it.

Consumer surplus

What will be an ideal response?

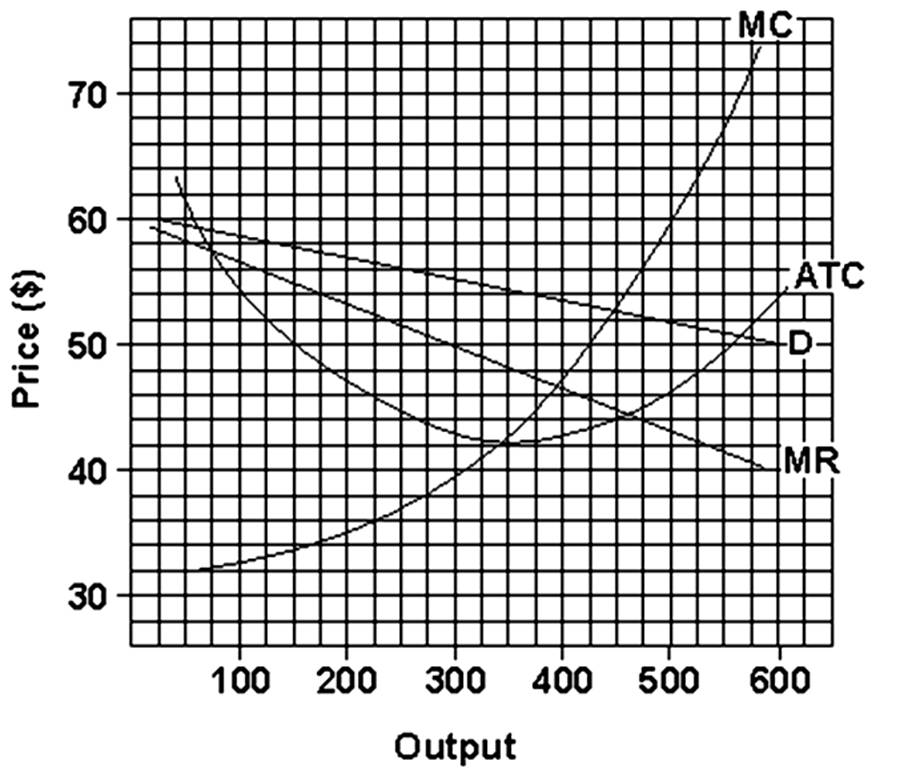

If the firm were a perfect competitor in the long run, how much would its output be?

A bank charges one borrower (A) 8 percent interest per year and another borrower (B) 10 percent interest per year. Which of the following is a plausible reason for the higher interest rate for B?

A. A is borrowing the money for a longer period than B B. A is borrowing a larger amount than B C. B is using the money for a less risky project than A D. B has a better credit rating than A