Centennial Company sold 600 units of inventory at $20 per unit on account. The company uses the perpetual inventory system and the last-in, first-out (LIFO) inventory costing system. The beginning inventory included 200 units at $9 per unit. The most recent purchases include 700 units at $12 per unit. The sale occurred after the last purchase.

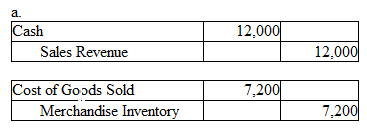

a. Prepare the journal entries to record the sale. Omit explanations.

b. Compute the cost of the ending inventory. Label your work.

Cost of goods sold = 600 units × $12 per unit

b. Ending inventory = beginning inventory (200 units × $9 per unit) + most recent purchases (100 units × $12 per unit)

Ending inventory = $1,800 + $1,200

Ending inventory = $3,000

You might also like to view...

Freud's theory of personality includes the ________

A) super ego B) ego C) id D) all of the above

______________________________ master data contains a record of each item that is stocked in the warehouse or regularly ordered from a vendor

Fill in the blank(s) with correct word

Monro Inc. uses the accrual method of accounting. Here is a reconciliation of Monro's allowance for bad debts for the current year.Beginning allowance for bad debts?$ 61,150??Actual write-offs of accounts receivable during the year?(80,000)?Addition to allowance? 88,500??Ending allowance for bad debts?$ 69,650???Which of the following statements is true?

A. Bad debt expense per books is $88,500, and the deduction for bad debts is $80,000. B. Bad debt expense per books is $80,000, and the deduction for bad debts is $88,500. C. Bad debt expense per books and the deduction for bad debts is $88,500. D. Bad debt expense per books and the deduction for bad debts is $69,650.

The accounts receivable turnover ratio indicates how quickly a firm collects its accounts receivable

Indicate whether the statement is true or false