On January 1, a company issues bonds dated January 1 with a par value of $400,000. The bonds mature in 5 years. The contract rate is 7%, and interest is paid semiannually on June 30 and December 31. The market rate is 8% and the bonds are sold for $383,793. The journal entry to record the first interest payment using straight-line amortization is:

A. Debit Interest Expense $12,379.30; debit Discount on Bonds Payable $1,620.70; credit Cash $14,000.00.

B. Debit Interest Expense $15,620.70; credit Premium on Bonds Payable $1,620.70; credit Cash $14,000.00.

C. Debit Interest Expense $14,000.00; credit Cash $14,000.00.

D. Debit Interest Expense $15,620.70; credit Discount on Bonds Payable $1,620.70; credit Cash $14,000.00.

E. Debit Interest Payable $14,000.00; credit Cash $14,000.00.

Answer: D

You might also like to view...

A depreciation of the dollar will have its most pronounced impact on imports if the demand for imports is

a. constant. b. inelastic. c. elastic. d. unitary elastic.

If Tanner Company becomes less creditworthy, the market price of its bonds will decline

a. True b. False Indicate whether the statement is true or false

Assume that you are the marketing manager of a firm that manufactures athletic shoes. How will you launch an encirclement attack on your competitor?

What will be an ideal response?

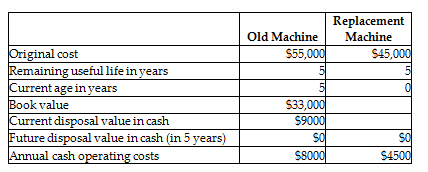

Which of the information provided in the table is irrelevant to the replacement decision?

Bradley Industries is considering replacing a machine that is presently used in its production process.

Which of the following is irrelevant to the replacement decision?

A) the sales price of the new machine

B) the original cost of the old machine

C) the current disposal value of the old machine

D) the annual cash operating costs for both machines