Assume the government decides to decrease taxes and to finance the expected budget deficit with borrowing in the real credit market. Where and how should you begin your analysis when analyzing the chain reaction of economic interactions?

a. Start the analysis in the real goods market with aggregate demand shifting to the left.

b. Start the analysis in the real goods market with aggregate demand shifting to the right.

c. Start the analysis in the real goods market with aggregate supply shifting to the left.

d. Start the analysis in the real goods market with aggregate supply shifting to the right.

e. Start the analysis in the real credit market with demand for real credit shifting to the right.

.E

You might also like to view...

The income-expenditure multiplier is the effect of a one-unit increase in:

A. after-tax disposable income on consumption. B. expenditure on potential output. C. after-tax disposable income on short-run equilibrium output. D. expenditure on short-run equilibrium output.

Two firms, A and B, each currently dump 20 tons of chemicals into the local river. The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river. The government gives each firm 10 pollution permits, which it can either use or sell to the other firm. It costs Firm A $100 for each ton of pollution that it

eliminates before it reaches the river, and it costs Firm B $50 for each ton of pollution that it eliminates before it reaches the river. After the two firms buy or sell pollution permits from each other, we would expect that a. Firm A will no longer pollute, and Firm B will not reduce its pollution at all. b. Firm B will no longer pollute, and Firm A will not reduce its pollution at all. c. Firm A will dump 10 tons of pollution into the river, and Firm B will dump 10 tons of pollution into the river. d. Firm A will increase its pollution and Firm B will reduce its pollution.

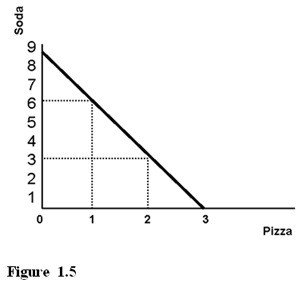

Referring to Figure 1.5, the opportunity cost of producing the third unit of pizza is

A. one unit of soda. B. six units of soda. C. three units of soda.

Which of the following is likely to lead to an increase in GDP per capita of a country?

A) An increase in the capital stock of the economy B) An increase in the unemployment rate in the country C) An increase in the tax rates in the country D) An increase in the interest rate in the country