Which of the following are ways in which corporations can reduce their U.S. tax burdens?

A) taking advantage of deductions and credits

B) shifting foreign profits to overseas subsidiaries

C) deducting past losses from income tax in profitable years

D) all of the above

D

You might also like to view...

Producers of DVDs are able to lower the wage rate that they pay to their workers. You predict that the

A) price will rise. B) quantity supplied will decrease. C) supply curve will shift leftward. D) supply curve will shift rightward.

In the long-run, all costs are

a. Fixed costs b. Variable costs c. Sunk Costs d. Marginal Costs

Attempts to influence interest rates, credit conditions, and the money supply are called

A. mixed economic policy. B. discounting. C. moral suasion. D. monetary policy.

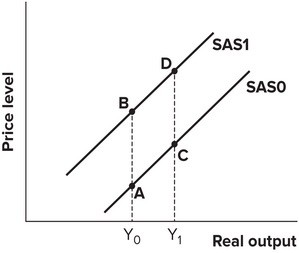

Refer to the graph shown. A movement from D to B is most likely to be caused by:

A. a decrease in input prices. B. a decrease in import prices. C. a decrease in aggregate demand. D. an increase in expected inflation.