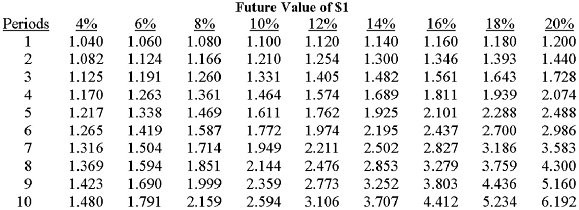

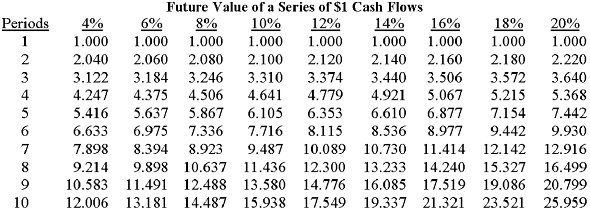

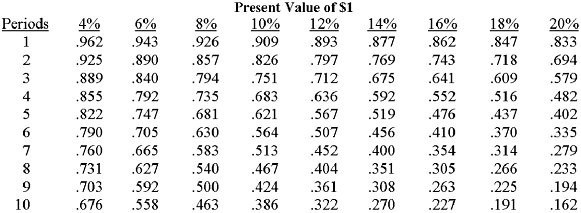

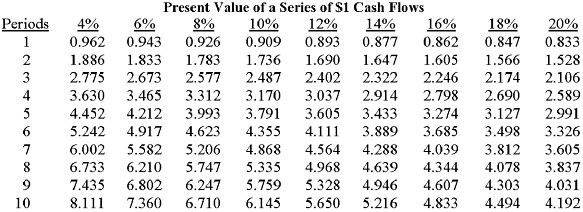

A machine costs $25,000; it is expected to generate annual cash revenues of $8,000 and annual cash expenses of $2,000 for five years. The required rate of return is 12%. Using the tables that follow, which of the following statements about the machine's internal rate of return is true?

style="vertical-align: 0.0px;" height="212" width="583" />

A. The internal rate of return is greater than 12%.

B. The internal rate of return is less than 10%.

C. The internal rate of return is between 10% and 12%.

D. The internal rate of return must be greater than 15%.

E. There is insufficient information to make any judgment about the internal rate of return.

Answer: B

You might also like to view...

Which of the following is an appraisal cost?

A. Customer service costs B. Depreciation of testing equipment C. Costs to repair defective units D. Engineering and design costs

Which of the following is/are not true?

a. U.S. GAAP and IFRS permit the employer to prepare consolidated financial statements with the retirement trust. b. The employer must report the net funded status of each defined benefit retirement plan (that is, the fair value of retirement trust assets minus the retirement trust obligation) as either an asset or a liability on its balance sheet. c. The employer must report the net funded status of each defined benefit retirement plan and credit (for an overfunded plan) or debit (for an underfunded plan) is to Other Comprehensive Income. d. Notes to the financial statements provide information about investments made by the retirement trust and how trust assets and liabilities changed during a period. e. all of the above

Which of the following was not an objective of the research project at Detroit Edison?

a. To develop through first-hand experience an understanding of the problems of producing change b. To improve relationships c. To insinuate factors related to change d. To develop working hypotheses for later, more directed research

State the prohibited practices under the Telephone Consumer Protection Act of 1991

What will be an ideal response?