The rise in bank failures in the late 1980s and early 1990s occurred

a. at Federally-charted banks only.

b. because Congress repealed many of the provisions of deposit insurance regulation.

c. at state-chartered banks, which are less closely regulated than other banks.

d. because the Federal Reserve began to monitor banks less often.

e. because they were insured by the Federal Deposit Insurance Corporation instead of state agencies.

C

You might also like to view...

The internal rate of return of a project can be found by

A) discounting all cash flows at the cost of capital. B) averaging all cash inflows, and calculating the interest rate, which will make them equal to the average investment. C) calculating the interest rate, which will equate the present value of all cash inflows to the present value of all cash outflows. D) None of the above

In a competitive market, if the production process involves an external cost, such as pollution of the environment, the market will

a. produce the economically efficient outcome. b. result in a market price that is higher than the efficient one. c. register a price that is lower than the efficient one. d. result in too little of the good being produced compared to the ideal efficient outcome.

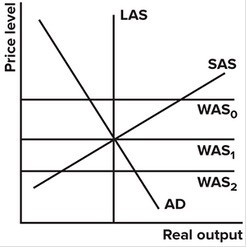

In the graph shown, which of the world supply curves create a trade deficit?

A. WAS0 B. WAS1 C. WAS2 D. None create deficits.

The Interstate Commerce Commission (ICC) regulates railroads, barges and trucks. Suppose technical change lowers the costs of railroads. As a result, the ICC permits railroads to lower prices some but also alters the rates of barges and trucks so they

get additional business. The ICC would be acting consistently with A) the capture theory of regulation. B) the public interest theory of regulation. C) the share-the-gains, share-the-pains theory of regulation. D) None of the theories presented in the text since economic regulation is specific to a single industry and not to agencies that cover more than one industry. That is the province of social regulation.