In an ideal organization, when do agents always make decisions in the best interests of their principle?

a. The decision makers have the information necessary to make the decision

b. The decision makers have the incentive to make the right decision

c. All of the above

d. None of the above

c

You might also like to view...

When a Peruvian buys a U.S. government bond, from the perspective of Peru, this is a(n):

A. capital inflow. B. export. C. capital outflow. D. import.

Dr. X, an assistant professor at a large state university, is trying to decide how to allocate the 50 hours a week she spends working among the various activities expected of an assistant professor. The professor wants to maximize her raise next year and the table shows estimates of how time spent in each activity will contribute to her raise:  Given the above information, what is Dr. X's maximum possible raise if she works 50 hours?

Given the above information, what is Dr. X's maximum possible raise if she works 50 hours?

A. $1860 B. $1845 C. $1495 D. $1600

Some economists argue that corporate income taxes are typically not paid by firms, but by

A. the board of directors of the firm. B. the government. C. bond holders. D. stockholders, employees, and consumers.

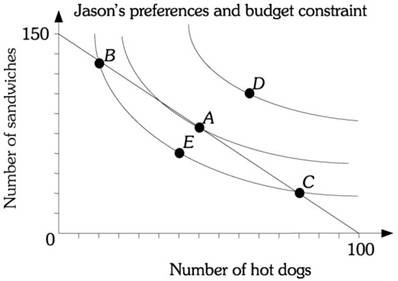

Refer to the information provided in Figure 6.15 below to answer the question that follows. Figure 6.15Refer to Figure 6.15. If the price of a hot dog is $2, Jason's income is

Figure 6.15Refer to Figure 6.15. If the price of a hot dog is $2, Jason's income is

A. $25. B. $200. C. $300. D. indeterminate because the price of sandwiches is not given.