A marginal tax rate is

A) the fraction of each additional dollar of income that must be paid in taxes.

B) the incremental income one must earn to offset each additional dollar of tax.

C) the ratio of a change in income to a change in taxes paid.

D) the fraction of income that must be paid in taxes.

A

You might also like to view...

During the Great Depression, as real interest rates rose, good credit risks were less likely to seek loans. This process illustrates the phenomenon of ________

A) adverse selection B) moral hazard C) poor monetary policy D) debt deflation

Suppose George's income is $10,000 and he pays a tax of $1,000 . but Laura's income is $50,000 and she pays a tax of $4,000 . Such a tax is:

a. regressive. b. progressive. c. proportional. d. flat.

According to public choice theory, a voter will favour a candidate whose political program is

a) favoured by the median voter b) perceived by the voter to be in his self-interest c) closest to efficiency d) all of the above

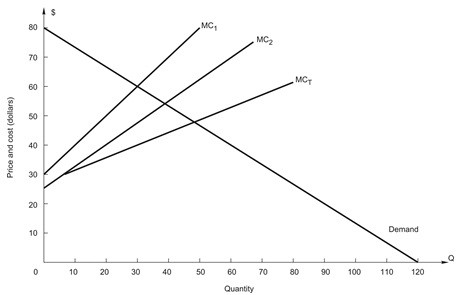

The figure above shows the demand and cost conditions for a firm with two plants. In order to maximize profit, how many units of output should the firm produce?

The figure above shows the demand and cost conditions for a firm with two plants. In order to maximize profit, how many units of output should the firm produce?

A. 10 B. 20 C. 30 D. 40 E. 50