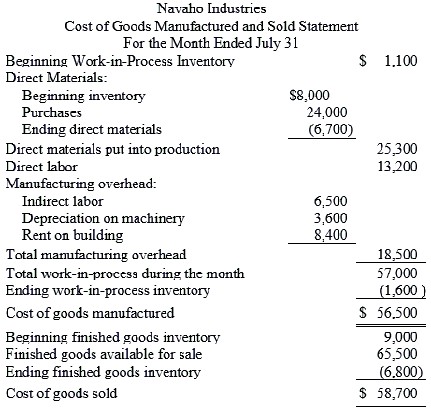

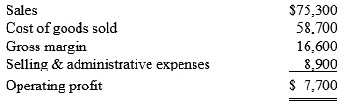

Information from the records of the Navaho Industries for the month of July is as follows: Purchases of direct materials$24,000 Indirect labor 6,500 Direct labor 13,200 Depreciation on factory machinery 3,600 Sales 75,300 Selling and administrative expenses 8,900 Rent on factory building 8,400 Inventories:July 1July 31Direct materials$8,000 $6,700 Work-in-process 1,100 1,600 Finished goods 9,000 6,800 Required:(a) Prepare a statement of cost of goods manufactured and sold for the month of July.(b) Prepare a gross margin income statement for the month of July.

What will be an ideal response?

(a)

(b)

You might also like to view...

According to Michael Porter, which of the following refers to a country's endowment of resources?

A) factor conditions B) dependent variables C) cultural dimensions D) value constructs

When a company acquires treasury stock, what effect does this transaction have on earnings per share and legal capital, respectively?

A) decrease, increase B) increase, decrease C) decrease, decrease D) increase, none

Which of the following is a characteristic of a plant asset, such as a building?

A) It is used in the operations of a business. B) It is available for sale to customers in the ordinary course of business. C) It has a short useful life. D) It will have a negligible value at the end of its useful life.

Devon Company uses activity-based costing to determine the costs of its two products: A and B. The total estimated cost of the purchasing function activity pool is $14,000. The cost driver for that pool equals number of purchase orders. A total of 400 purchase orders are expected to be issued for the budgeted production of Product A and 300 purchase orders are expected to be issued for the budgeted production of Product B. The activity rate for the purchasing cost pool is: