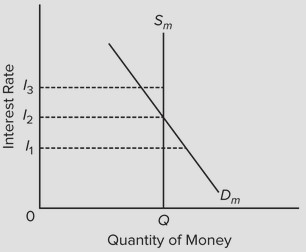

Use the following diagram for the market for money to answer the next question. The vertical money supply curve Sm reflects the fact that

The vertical money supply curve Sm reflects the fact that

A. bond prices and interest rates are inversely related.

B. the rate at which money is spent is zero.

C. the stock of money is determined by the Federal Reserve System and does not change when the interest rate changes.

D. lower interest rates result in lower opportunity costs of supplying money.

Answer: C

You might also like to view...

Which of the following is the best example of an automatic stabilizer?

a. a balanced federal budget b. the minimum wage c. unemployment compensation program d. discretionary fiscal policy

If the equilibrium exchange rate between U.S. dollars and Japanese yen is $0.01 = 1 yen but currently the exchange rate is $0.0089 = 1 yen, then a __________ exists

A) shortage of dollars B) surplus of dollars C) surplus of yen D) shortage of yen E) b and d

Output in the short run is determined by which of the following factors when an economy operates at full employment?

A. demand B. supply C. the price level D. the labor force

When did NAFTA go into effect?

What will be an ideal response?