How do financial intermediaries reduce risk?

What will be an ideal response?

Financial intermediaries reduce risk by diversifying investors' assets. One way intermediaries do this is by investing in a large number of projects whose returns are independent of one another.

You might also like to view...

The table above gives four production possibilities for airplanes and cruise ships. In possibility A, how many resources are devoted to the production of airplanes?

A) 0 B) few C) most D) all E) It is impossible to tell without more information about the prices of airplanes and cruise ships.

Typically, the most important determinant of private investment in an economy is

A) the inflow of foreign investment. B) the size of the capital account surplus. C) the size of the current account deficit. D) the outflow of private investment. E) the amount of domestic savings.

If the economy is in recession and the number of used baby clothing stores increases, then:

a. used baby clothes are a necessity. b. used baby clothes are an inferior good. c. used baby clothes are a normal good. d. new baby clothes are a luxury. e. used baby clothes have price-elastic demand.

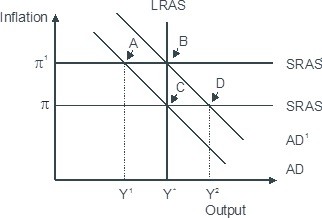

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary