________ is buying a country's currency spot and selling that country's currency forward, to make a net profit from the combination of the difference in interest rates between countries and the forward premium on the country's currency.

A. Uncovered interest parity

B. Covered interest arbitrage

C. Uncovered interest arbitrage

D. Covered interest parity

Answer: B

You might also like to view...

Refer to the figure above. How many units of Good X will be demanded if the government sets a price ceiling of Pc on the good?

A) 0 units B) 10 units C) 25 units D) 35 units

If a scale economy is the dominant technological factor defining or establishing comparative advantage, then the underlying facts explaining why a particular country dominates world markets in some product may be pure chance, or historical accident

Explain, and compare this with the answer you would give for the Heckscher-Ohlin model of comparative advantage.

Your aunt owns a gold mine. The marginal extraction cost of gold is $25 and remains constant over time. The current market price of a unit of gold is $200. Your aunt's appropriate discount rate is 12%

Next year, your aunt expects the price of a unit of gold to be $222. Should your aunt extract any gold from the mine this year?

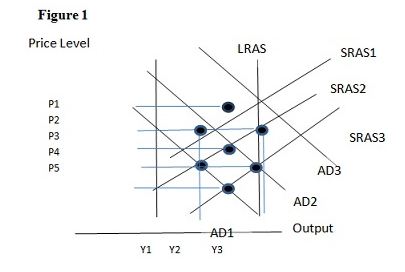

Using Figure 1 below, if the aggregate demand curve shifts from AD2 to AD3 the result in the short run would be:

A. P1 and Y2.

B. P3 and Y1.

C. P2 and Y3.

D. P2 and Y2.