The mission statement of the Financial Accounting Standards Board includes a goal of promoting international comparability of accounting standards. Furthermore, the International Accounting Standards Board has begun over the last 20 years to issue

international accounting standards designed to create a common set of international accounting and reporting standards. Identify reasons why such a set of international accounting standards would be desirable.

A common set of international accounting standards would enhance the comparability of the financial information produced by enterprises in countries throughout the world. Comparability would allow United States and foreign companies to better assess their position relative to their competitors. Comparability also would facilitate the management of relationships with customers, suppliers, and others throughout the world. Additionally, comparability would ease the process of raising capital or investing in foreign securities. Foreign companies wishing to list their equity securities on the New York Stock Exchange, for example, must convert their financial statements and accompanying notes to U.S. generally accepted accounting principles. This can be a very costly and time-consuming process. International accounting standards accepted in all countries could eliminate the cost of such a conversion and speed the process of raising capital.

You might also like to view...

The post-closing trial balance will generally have fewer accounts than the trial balance

Indicate whether the statement is true or false

Which of the following pricing policies involves entering a market with a single low price and not significantly increasing the price even upon gaining a major market share?

A. skimming price policy B. introductory price dealing C. penetration pricing policy D. temporary price cut policy E. zone pricing policy

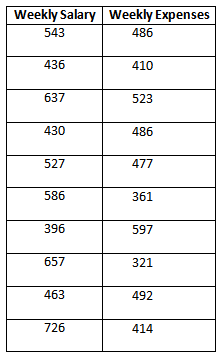

State the critical value.

Which of the following statements regarding dependents is true?

A. To qualify as a dependent of another, an individual must be a resident of the United States. B. To qualify as a dependent of another, an individual must be either a qualifying child or a qualifying relative of the other person. C. To qualify as a dependent of another, an individual may not file a joint return with the individual's spouse under any circumstance. D. To qualify as a dependent of another, an individual must have a family relationship with the other person.