Suppose that electricity producers create a negative externality equal to $6 per unit. Further suppose that the government imposes a $8 per-unit tax on the producers. What is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

a. They are equal.

b. The after-tax equilibrium quantity is greater than the socially optimal quantity.

c. The after-tax equilibrium quantity is less than the socially optimal quantity.

d. There is not enough information to answer the question.

c

You might also like to view...

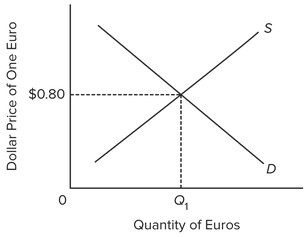

Use the following graph to answer the next question. All else held constant, a leftward shift of the demand curve would ________.

All else held constant, a leftward shift of the demand curve would ________.

A. cause a surplus of euros B. appreciate the euro C. depreciate the dollar D. reduce the equilibrium quantity of euros

The expenditure approach to measuring U.S. GDP equals _________

A. the sum of U.S. consumption expenditure and U.S. investment B. U.S. government expenditure minus taxes paid by Americans C. all expenditure on final goods and services produced in the United States in a given time period D. all expenditure by Americans on goods and services produced in the United States in a given time period

When all the factors of aggregate expenditure are influenced by income, the multiplier becomes a function of the: a. marginal propensity of government purchases

b. marginal propensity to consume out of disposable income. c. marginal propensity of aggregate expenditure. d. marginal propensity to import.

Shortage of a good occurs if: a. the price of the good is higher than the equilibrium price

b. the government imposes a restriction on the consumption of the good. c. buyers want to buy more than sellers want to sell. d. buyers want to buy less than sellers want to sell.