If the annual nominal interest rate on 5-year U.S. Government Treasury bonds is 7%, and the annual nominal interest rate on 5-year Canadian bonds is 5.5%, what is the expected future spot rate in 5 years given that the current spot exchange rate between U.S. dollars and Canadian dollars is $0.587?

A) $0.595

B) $0.547

C) $0.578

D) $0.630

D

You might also like to view...

Examples of the kinds of internal forces listed in the text are each of the following except

A. human resources. B. capital. C. labor. D. taxation. E. production.

______ conflict is personal conflict that tends to hurt relationships and decrease performance.

A. Functional B. Forcing C. Dysfunctional D. Avoiding

Indicate whether each of the following statements is true or false.________ a) The extension of a warranty on goods sold normally represents a legal obligation to the seller of the goods.________ b) The entry to recognize the warranty obligation increases the Warranties Payable account and decreases a revenue account.________ c) The entry to record the payment of cash to settle a warranty claim increases expenses (Warranties Expense) and decreases liabilities (Warranties Payable).________ d) Net income is not affected by the entry to record the payment of cash to settle a warranty claim.________ e) Total assets are not affected by the adjusting entry to record the warranty obligation.

What will be an ideal response?

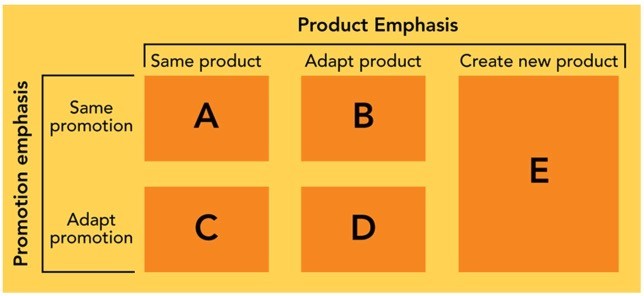

Figure 6-4Global companies have five strategies for matching products and their promotion efforts to global markets. According to Figure 6-4 above, B refers to which type of strategy?

Figure 6-4Global companies have five strategies for matching products and their promotion efforts to global markets. According to Figure 6-4 above, B refers to which type of strategy?

A. communication adaptation strategy B. product extension strategy C. product invention strategy D. product adaptation strategy E. dual adaptation strategy