A multinational corporation is planning to implement a common set of performance management practices throughout its global subsidiaries. What advice would you offer to the HRM director of the firm in relation to this plan and why?

What will be an ideal response?

Good answers will discuss duality and challenges between global integration and local adaptation; issues related to transfer of practices, implementation and internalisation; cultural and institutional differences between different nations with regard to performance and behaviour. Better answers will also note different international orientations (Perlmutter); the impact of e-HRM system; use examples and discuss the policy/implementation gap and the role of line managers. Include critical analysis, evaluation and a synthesis.

You might also like to view...

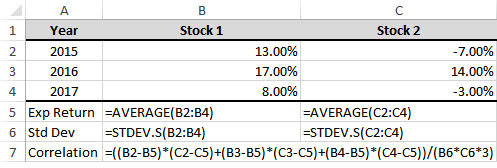

You wanted to verify that formula 14-2 on page 429 is correct, so you entered the formula in B7 and entered Excel’s built-in function CORREL in cell B9; however, you get 47.95% in B7 and 71.93% in B9. Since the formulas in both cells are correct, where is the error?

a) The functions on cells B5 and C5 should be MEDIAN instead of AVERAGE

b) The functions on cells B6 and C6 should be STDEV.P instead of STDEV.S

c) The functions on cells B5 and C5 should be MODE instead of AVERAGE

d) The functions on cells B6 and C6 should be STDEVA instead of STDEV

e) The functions on cells B6 and C6 should be VAR instead of STDEV

A suggestive use of ordinary words may not be trademarked.

Answer the following statement true (T) or false (F)

A firm wishes to establish a fund which, in 10 years, will accumulate to $10,000,000. The fund will be used to repay an outstanding bond issue

The firm plans to make deposits, which will earn 12 percent, to this fund at the end of each of the 10 years prior to maturity of the bond. How large must these deposits be to accumulate to $10,000,000?

Which of the following is not included in a cash flow statement?

A) Labor productivity B) Interest earnings C) Cash flow from operations D) Depreciation expense E) The increase in long-term debt