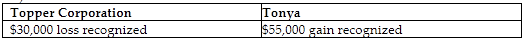

Topper Corporation makes a liquidating distribution of land to its sole shareholder Tonya. Topper purchased the land several years ago for $150,000, and the land was recently appraised at $120,000 of value. Tonya purchased her stock three years ago for $65,000. What is the amount of gains or losses recognized by Topper Corporation and Tonya?

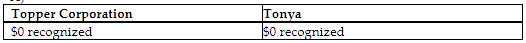

A)

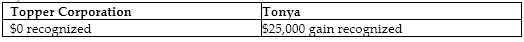

B)

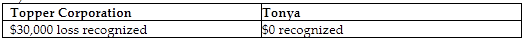

C)

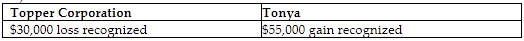

D)

D)

A corporation recognizes gain or loss on assets distributed in liquidation as if the assets had been sold at fair market value so Topper Corporation will recognize a $30,000 loss ($120,000 FMV - $15,000 basis). The shareholder is deemed to have sold her stock for the cash plus FMV of assets received in the liquidation so Tonya will recognize a $55,000 gain on her stock ($120,000 FMV of land received - $65,000 basis of stock).

You might also like to view...

________ cannot be separated from the entity and sold, transferred, licensed, rented, or exchanged

A) ?Internally developed identifiable intangible asset B) ?Tangible asset C) Purchased identifiable intangible asset? D) ?Unidentifiable intangible asset

In a large company, the person who is responsible for comparing cash and the bank balance is the ________

A) CEO B) CFO C) controller D) treasurer

What is the difference between a table in first normal form and one in second normal form?

What will be an ideal response?

Daniel's business constructs storage sheds for new housing developments as requested by the builders. Daniel's business would best be classified as a

A. service business. B. retailer. C. distribution business. D. production business. E. wholesaler.