In May 2019, Preston purchases 5-year MACRS property costing $150,000 and 7-year MACRS property costing $60,000. Preston's income is $100,000. Preston does not want to claim bonus depreciation. If Preston wishes to maximize his total 2019 cost recovery deduction, what will his total cost recovery deduction be on the properties purchased in 2019?

A. $100,000

B. $122,000

C. $210,000

D. $42,000

E. $34,430

Answer: B

You might also like to view...

A court may find two persons to be partners even though neither had the specific intent to create a partnership.

Answer the following statement true (T) or false (F)

The buying process starts when the buyer decides to, or enters, a store or service provider's facility

Indicate whether the statement is true or false

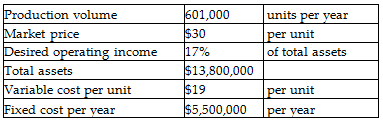

With the current cost structure, Aguilar cannot achieve its profit goals. It will have to reduce either the fixed costs or the variable costs. Assuming that fixed costs cannot be reduced, what are the target variable costs per unit per year? Assume all units produced are sold. (Round your answer to the nearest cent.)

Aguilar Company is a price-taker and uses target pricing. Refer to the following information:

A) $5.10

B) $11.00

C) $16.95

D) $19.00

When a party to a contract notifies the other party that it will not perform the contract as agreed, this conduct is referred to as

a. specific performance. b. cover. c. repudiation. d. assurance.