A stock is expected to pay a dividend of $2.50 per share indefinitely. The stock is expected to generate a return of 8 percent in the foreseeable future. Based on this information, a fair price of this stock would be

A) $25.00.

B) $31.25.

C) $20.00.

D) Cannot be determined without additional information.

B

You might also like to view...

On the "supply side" of a market, producers indicate to consumers what they are willing to sell, in what quantity and at what price

Indicate whether the statement is true or false

The gold standard period was

A) up until the first world war. B) between the first and second world wars. C) following the second world war until 1970. D) between 1954 and 1970. E) between 1814 and 1865.

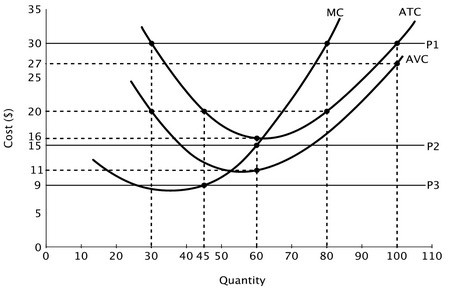

Refer to the accompanying graph. If this firm is a price taker, then when the price of each unit if output is $15, what is this firm's profit-maximizing level of output?

A. 60 B. 45 C. 80 D. 0

Suppose a senior college football player approaches an insurance company and seeks to purchase an insurance policy against him receiving a career-ending injury. The insurance company

A) will sell him an insurance policy because the proposal entails uncertainty not risk. B) will sell him an insurance policy because the proposal entails risk not uncertainty. C) will not sell him an insurance policy because the proposal entails uncertainty not risk. D) will not sell him an insurance policy because the proposal entails risk not uncertainty.