Omar Industries manufactures two products: Regular and Super. The results of operations for 20x1 follow. Regular Super TotalUnits 10,000 3,700 13,700 Sales revenue$240,000 $740,000 $980,000 Less: Cost of goods sold 180,000 481,000 661,000 Gross Margin$60,000 $259,000 $319,000 Less: Selling expenses 60,000 134,000 194,000 Operating income (loss)$0 $125,000 $125,000 Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.Omar Industries wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by

10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

A. $10,400 increase.

B. $20,000 increase.

C. $39,600 decrease.

D. $0.

E. None of the answers is correct.

Answer: C

You might also like to view...

Most longterm liabilities are related to a firm's investing activities

a. True b. False Indicate whether the statement is true or false

Which statement is LEAST accurate?

a. Implementing an ERP system has as much to do with changing the way an organization does business than it does with technology. b. The big-bang approach to ERP implementation is generally riskier than the phased in approach. c. To take full advantage of the ERP process, reengineering will need to occur. d. A common reason for ERP failure is that the ERP does not support one or more important business processes of the organization

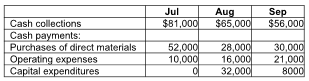

The cash balance on June 30 is projected to be $11,000. Based on the above data, calculate the cash balance the company is projected to have at the end of September.

Roberts Supply, Inc. provides the following data taken from its third quarter budget:

A) $16,000

B) $19,000

C) $75,000

D) $59,000

The property and liability insurance industry fluctuates between periods of increasing insurance rates and tight underwriting standards,

and decreasing insurance rates and loose underwriting standards. Profitability in the industry follows these cyclical movements. What is this pattern of fluctuations called? A) the claims cycle B) the underwriting cycle C) the business cycle D) the accounting cycle