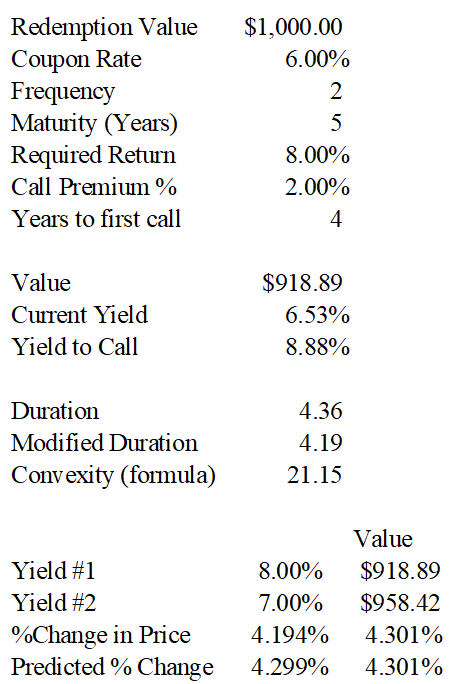

You are considering the bonds of Epsilon, Inc., a printer manufacturer. The bonds make semiannual payments and have five years to maturity, a coupon rate of 6%, and a redemption value of $1,000.

a) Determine the intrinsic value of these bonds assuming that your required rate of return is 8% (use the PV function). Also determine the current yield and the yield to call (use the RATE function) if the bonds can be called in four years with a call premium of 2%.

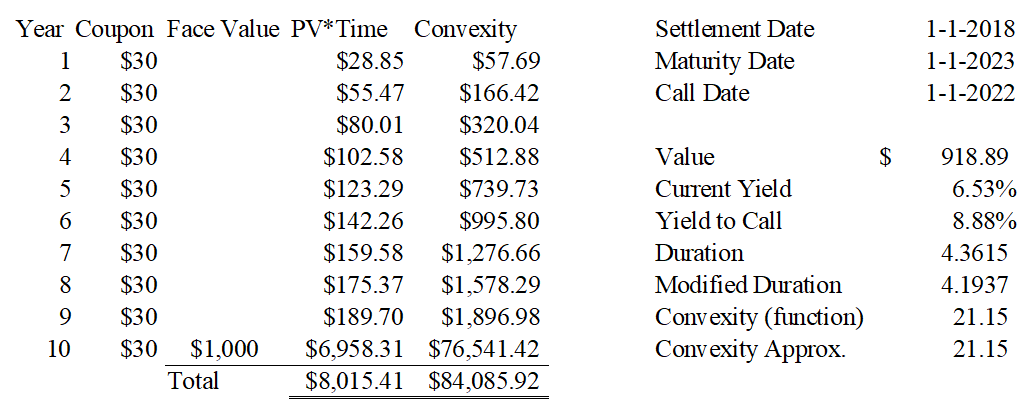

b) Determine the duration, modified duration, and convexity of these bonds using formulas 10-5, 10-6, and 10-10 provided in the text book.

c) Now assume that the settlement date for your purchase would be 01/01/2018. Using the Price, Yield, Duration, MDuration, and Fame_Convexity functions, recalculate your answers in parts (a) and (b).

d) Determine the percentage change in price if market rates decline by 1%. Determine the actual relative change in bond prices using the intrinsic values for each rate. Compare this result with those obtained using the formulas with the modified duration only and with the modified duration and convexity together.

You might also like to view...

The notification accompanying a check that indicates the specific invoice being paid is called a

A) remittance advice B) voucher C) debit memo D) credit memo

Measurable objectives are rational and allocate an adequate amount of resources to support their

completion. Indicate whether the statement is true or false

Each ANN is composed of a collection of neurons that are grouped into layers. One of these layers is the hidden layer. Define the hidden layer

What will be an ideal response?

Intergroup conflict in organizations is never intentionally stimulated.

Answer the following statement true (T) or false (F)