Packard Corporation reported pretax book income of $500,000. Included in the computation were favorable temporary differences of $10,000, unfavorable temporary differences of $100,000, and unfavorable permanent differences of $80,000. The corporation's current income tax expense or benefit would be:

A. $105,000 tax benefit.

B. $121,800 tax expense.

C. $140,700 tax expense.

D. $123,600 tax benefit.

Answer: C

You might also like to view...

What are the two main communication networks called?

A. endorsed and unsubstantiated B. formal and informal C. approved and unapproved D. official and unofficial

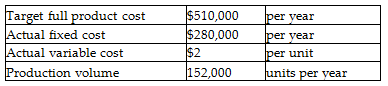

Actual costs are currently higher than target full product cost. Assuming that fixed costs cannot be reduced, what are the target total variable costs?

Abbott Company is a price-taker and uses target pricing. The company has just done an analysis of its revenues, costs, and desired profits and has calculated its target full product cost. Assume all products produced are sold. Refer to the following information:

A) $280,000

B) $304,000

C) $230,000

D) $510,000

Can you write an effective introduction by creating feelings of stress or discomfort?

A) Yes. B) No.

When preparing an NPV analysis on the disposal of an asset, like equipment, capital gains and losses are taxed at the same rate as ordinary income in the analysis.

Answer the following statement true (T) or false (F)