You borrow $10,000 from a bank for one year at a nominal interest rate of 5%. The CPI over that year rises from 180 to 200. What is the real interest rate you are paying?

A) 15%

B) 5%

C) -1.1%

D) -6.1%

Answer: D

You might also like to view...

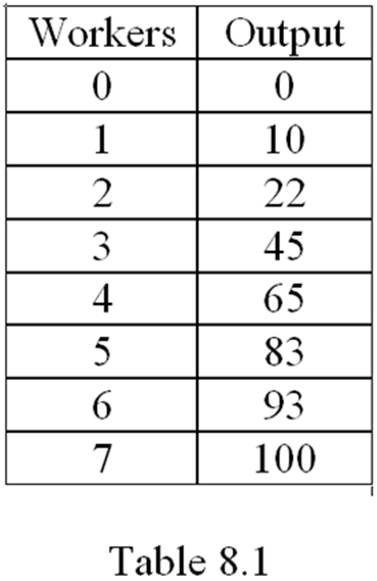

Refer to Table 8.1. Assume the wage rate is $10 and the firm has $1,000 in unavoidable fixed cost. What is the average cost of producing 65 units of output?

A. $40

B. $15.38

C. $0.50

D. $16

Exhibit 2-2 Production possibilities curve

A. coffee is constant. B. coffee is increasing. C. coffee is decreasing. D. corn is increasing.

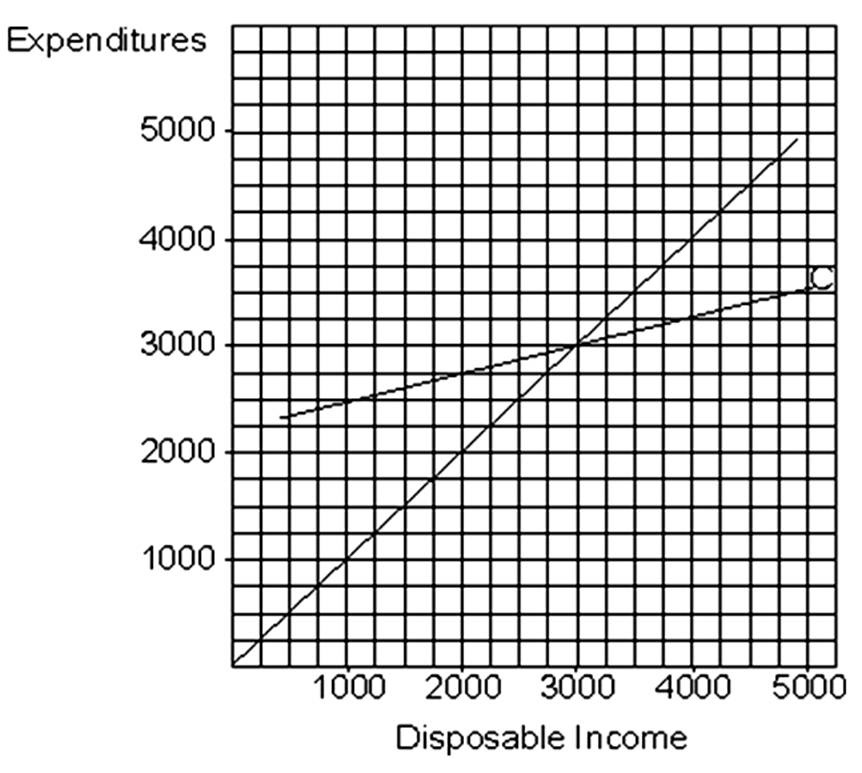

In this graph, consumption is at the level of 2,500 when disposable income is

A. 0.

B. 1000.

C. 2000.

D. 3000.

The Tokyo Round of the GATT negotiations was notable because it was the first round

A) that included Japan. B) that included textiles and apparel. C) to begin establishing rules on subsidies. D) to begin discussions of exchange rates.