Suppose the Fed increases the money supply. As a result of this, people deposit excess funds into their bank accounts, causing banks to have excess reserves

As a result, the banks lower the interest rates that they charge on loans, and investment rises, causing an increase in aggregate spending. This is known as a(n) A) direct effect of monetary policy.

B) indirect effect of monetary policy.

C) direct effect of fiscal policy.

D) indirect effect of fiscal policy.

B

You might also like to view...

Based on the table above, the equilibrium price level is

A) 130. B) 120. C) 110. D) 100. E) 90.

The money market is where money demand and money supply determine the equilibrium ______ interest rate.

a. nominal b. real c. gross d. net

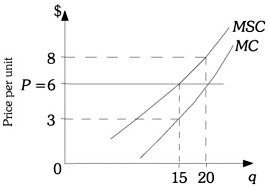

Refer to the information provided in Figure 16.3 below to answer the question(s) that follow.  Figure 16.3Refer to Figure 16.3. If this firm is maximizing profits and is not required to take into account damages, it will produce

Figure 16.3Refer to Figure 16.3. If this firm is maximizing profits and is not required to take into account damages, it will produce

A. 0 units of output. B. 6 units of output. C. 15 units of output. D. 20 units of output.

Suppose the marginal product of labor in the economy is given by MPN = 200 - 0.5 N, while the supply of labor is 100 + 4w.(a)Find the market-clearing real wage rate.(b)What happens if the government imposes a minimum wage of 40? Is there involuntary unemployment?(c)What happens if the government imposes a minimum wage of 60? Is there involuntary unemployment?

What will be an ideal response?