?Bella, Inc. manufactures two kinds of bagslong dashtotes and satchels. The company allocates manufacturing overhead using a single plantwide rate with direct labor cost as the allocation base. Estimated overhead costs for the year are $ 24000. Additional estimated information is given below.

Totes

Satchels

Direct materials cost per unit

$ 35

$ 45

Direct labor cost per unit

$ 52

$ 64

Number of units

540

390

Calculate the predetermined overhead allocation rate.? (Round your answer to two decimal? places.)

Ans:

Pre. Allocation= total estimated OH costs/total estimated quantity

52x540=28,080

64x390=24960

24960+28,080=53040

24,000/53040=45.25%

You might also like to view...

The balance of the allowance for bad debts account after adjustment, using the percentage of sales method, must be equal to the percent of uncollectible accounts multiplied by the amount of credit sales

a. True b. False Indicate whether the statement is true or false

________ is the most important personal characteristic needed to be a successful salesperson.

A. Persistence B. Patience C. Extroversion D. Knowledge E. Caring for customers

All of the following are reasons that marketers may be losing confidence in network television advertising EXCEPT which one?

A) Production expenses for a polished TV commercial can be substantial. B) Network television no longer commands the majority of broadcast spending. C) Many viewers are using DVRs to watch television shows after they have aired. D) Network television advertising is not as effective at marketing toward smaller and more narrowly defined target markets. E) The results of network television advertising are not as easily measurable as the results of Internet advertising.

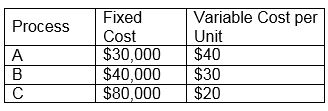

ABC Corporation would like to evaluate three production processes (A, B, and C) to accommodate the changes in demand for its products. The fixed and variable costs per unit are tabled here. Determine the most cost-effective process for an expected annual production volume of 2,000 units.

A. Process A

B. Process B

C. Process C

D. cannot be determined