Psychologists Daniel Kahneman and Amos Tversky conducted the following experiments by asking a sample of people the following questions:

Scenario A: "Imagine that you have decided to see a play and paid the admission price of $10 per ticket.

As you enter the theater you discover that you have lost the ticket. The seat was not marked and the ticket cannot be recovered. Would you pay $10 for another ticket?"

Scenario B: "Imagine that you have decided to see a play where admission is $10 per ticket. As you enter the theater you discover that you have lost a $10 bill. Would you still pay $10 for a ticket for the play?"

As long as additional tickets are available, there's no meaningful difference between losing $10 in cash before buying a ticket, and losing the $10 ticket after buying it. In both cases, you are out $10. Yet, far more subjects (88 percent) in Scenario B say they would pay $10 for another ticket and see the play while in Scenario A, only 46 percent of the subjects say they would be willing to spend another $10 to see the play.

Which of the following is the best explanation for the results of the experiment?

A) The endowment effect applies in Scenario A since people already own the ticket and therefore it is more valuable but this is not so in Scenario B.

B) In Scenario A, people make an immediate connection between the lost ticket and the play and feel poorer by incorrectly assigning a greater value to the value of the ticket whereas in Scenario B, they do not make the connection between the lost $10 bill and the play.

C) In Scenario B, people had not anticipated spending an additional $10 so in effect the price of the ticket is $20 and not $10 whereas in Scenario A, the price of the ticket is still $10.

D) The net benefit derived from watching the play is lower in Scenario A where the effective cost is $20 compared to the net benefit in Scenario B.

B

You might also like to view...

The major factor contributing to the depreciation of the Euro in 1999 and 2000 was:

A) low interest rates in the U.S. relative to Europe. B) high interest rates in the U.S. relative to Europe. C) trade barriers in Europe. D) none of the above.

Suppose that the equilibrium price of apples decreases and the equilibrium quantity of apples increases. This is best explained by:

A. an increase in the demand for apples. B. an increase in the supply of apples. C. a decrease in the demand for apples. D. a decrease in the supply of apples.

A firm pays Pam $40 per hour to assemble personal computers. Each day, Pam can assemble 4 computers if she works 1 hour, 7 computers if she works 2 hours, 9 computers if she works 3 hours, and 10 computers if she works 4 hours. Pam cannot work more than 4 hours day. Each computer consists of a motherboard, a hard drive, a case, a monitor, a keyboard, and a mouse. The total cost of these parts is $600 per computer. What is the marginal cost of producing the computers that Pam can assemble during her 2nd hour of work?

A. $4,200 B. $4,280 C. $1,800 D. $1,840

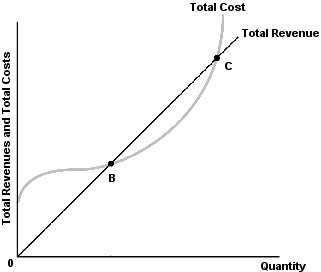

Refer to the above figure. Profits for this firm are positive

Refer to the above figure. Profits for this firm are positive

A. only at points B and C. B. for points between B and C. C. for all points less than B and greater than C. D. only for all points less than B.