To implement an efficient Pigouvian tax in a competitive market that has negative production externalities, the government would need to know the shape of the entire social marginal cost curve.

Answer the following statement true (T) or false (F)

False

Rationale: The government would only need to know the difference between marginal social cost and marginal private cost at the efficient output level.

You might also like to view...

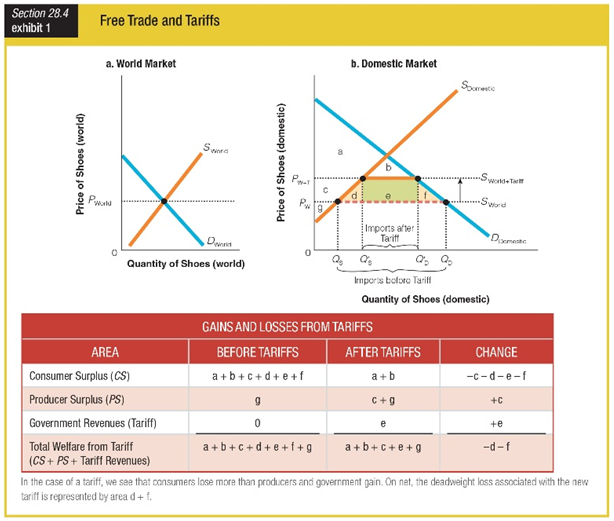

What is the change in total welfare as a result of the tariff on shoes as shown in Exhibit 1?

a. loss of areas d, e, and f

b. loss of areas d and f

c. gain of area e

d. gain of area g

National income can be calculated by subtracting

A. depreciation from GDP. B. indirect business taxes from GDP. C. depreciation and indirect business taxes from GDP. D. transfer payments and taxes from GDP.

External effects from a transaction indicate there is a misalignment between private and social benefits or costs.

Answer the following statement true (T) or false (F)

Sulfur Dioxide Discharged (Tons)Firm AFirm B10$8,000$9,000910,00012,000815,00018,000720,00027,000628,00037,000 Table 9.7 shows the production cost for two utilities at different levels of sulfur dioxide emissions. Assume that the government issued 8 marketable pollution permits to each firm. If Firm A contemplates selling one permit to Firm B, what is Firm A's willingness to accept?

Table 9.7 shows the production cost for two utilities at different levels of sulfur dioxide emissions. Assume that the government issued 8 marketable pollution permits to each firm. If Firm A contemplates selling one permit to Firm B, what is Firm A's willingness to accept?

A. $3,000 B. $5,000 C. $6,000 D. $7,000