In the story about Stuart Mease at Virginia Tech, Stuart gave an example of an ethical dilemma. Which of the following was this ethical dilemma?

a. Taking a meal allowance per diem while traveling even though the client paid for the meal

b. Reporting on your taxes a gift to a child even though the exchange was not a gift

c. Not telling a professor he/she reported the incorrect grade on your report card

d. Accepting credit for a task that you did not perform

a. Taking a meal allowance per diem while traveling even though the client paid for the meal

You might also like to view...

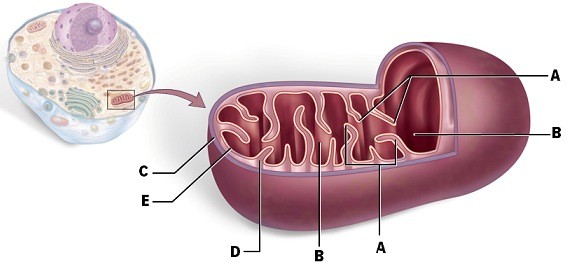

Identify "A."

A. intermembrane space B. outer membrane C. matrix D. grana E. cristae

Answer the following statements true (T) or false (F)

Assessment measures are concerned with particular attributes of objects and are always direct measurements.

Slick It, Inc. ? Render is a salesperson for Slick It, Inc. Slick It does not sell products with its own brand name. Instead, its products are created for different retail stores and carry the store brand. Render thought that several changes needed to be made to a particular product, but Slick It management reminded him that the stores, not Slick It, owned the brand. ? However, because Slick It had been concerned about dropping sales, management listened to Render's concerns about the company's pricing. He suggested using a different pricing strategy. More specifically, he felt that the company should incorporate a multiple-unit pricing strategy because it would then allow Slick It to set a single price for multiple units. This had the potential of increasing sales and therefore

profits, so management agreed to consider Render's suggestion. Refer to Slick It, Inc. The multiple-unit pricing strategy suggested by Render is a(n) ____ strategy. A. new product B. psychological C. equilibrium D. promotional E. place

Peanut Corporation acquired 80 percent of Snoopy Company's voting shares on January 1, 20X8, at underlying book value. On Dec. 31, 20X8, it also purchased $500,000 par value 8 percent Snoopy bonds, which had been issued on January 1, 20X5 to Schulz Corporation (unaffiliated with either Peanut or Snoopy) at a $45,000 premium. The bonds were originally issued with a 12-year maturity and pay interest annually on December 31. During preparation of the consolidated financial statements for December 31, 20X8, the following consolidating entry was included in the consolidation worksheet: Bonds Payable500,000 Bond Premium33,769 Loss on Bond Retirement16,875 Investment in Snoopy Company Bonds 550,644Based on the information given above, what is the interest income that must be eliminated in

preparing the 20X9 consolidated financial statements? A. $34,944 B. $33,769 C. $16,894 D. $27,957