If the government spends more than it receives in taxes during a given interval, then the result is

A) a balanced budget.

B) the gross public debt.

C) the net public debt.

D) a government budget deficit.

D

You might also like to view...

Refer to Scenario 5.6. The expected utility of income from research is

A) u($275,000 ). B) u($95,000 ). C) [u($500,000 ) + u($50,000 )]/2. D) .1 u($500,000 ) + .9 u($50,000 ). E) dependent on which outcome actually occurs.

A recession can be expected to reduce inflation in the economy if the recession is caused by a(n)

a. increase in aggregate demand. b. increase in aggregate supply. c. decrease in aggregate demand. d. decrease in aggregate supply.

If the CPI was 106.1 in Year 1 and was 112.4 for Year 2, then the rate of Inflation between Year 1 and Year 2 was:

(a) 5.9%. (b) 6.3%. (c) 5.6%. (d) 12.4%.

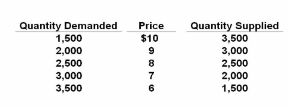

Refer to the given data. If government provides a per-unit subsidy of $2 to suppliers of this product, equilibrium price and quantity would be:

A. $9 and 3,000.

B. $7.50 and 2,250.

C. $8.50 and 2,750.

D. $7 and 3,000.