Suppose an individual faces a decision of whether or not to make an investment 2 years from now. The investment will cost $10,125, and it will yield a benefit b 2 years later.

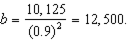

a. Suppose the individual treats a dollar 1 year from now the same way as $0.90 now. How low can b be for this individual to plan to make the investment in two years?

b. Now suppose that the individual's tastes are better characterized by the beta-delta model. Suppose delta is 0.9. For what values of beta will the individual plan the same course of action 2 years from now as he would in the typical delta model (with the same delta)?

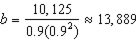

c. Suppose beta is 0.9 (with delta also equal to 0.9). How low can b be in order for the individual to be willing to undertake the investment when he faces the choice in 2 years?

d. For what range of values for b does the individual from (c) plan to undertake the investment but then decides not to when the time comes?

What will be an ideal response?

b. Regardless of what value beta takes, future plans are unaffected.

c.

d. For the range from 12,500 to 13,889.

You might also like to view...

The unemployment rate will decrease whenever there is a(n):

a. increase in the number of persons classified as unemployed. b. decrease in the number of unemployed relative to the size of the labor force. c. decrease in the size of the population and there is no change in the number of persons classified as employed. d. reduction in the size of the labor force. e. decrease in the number of unemployed and the population does not change.

The more elastic the supply curve, the ____ will be the effect of a tax on the quantity exchanged and the ____ will be the welfare cost. a. greater; greater

b. greater; smaller. c. smaller; greater. d. smaller; smaller.

Which of the following is a false statement about absolute and comparative advantage?

a. Comparative advantage is the basis for gains from trade. b. It is possible for one country to have the absolute advantage in all goods. c. It is possible for one country to have the comparative advantage in all goods. d. To find comparative advantage, you need to consider opportunity cost. e. All of these statements are true.

A primary goal of central banks is to:

A. reduce systematic risk. B. keep stock and bond prices high. C. keep inflation rates high. D. reduce the idiosyncratic risk that impacts specific investments.