The primary function of taxes is to

A. Increase the purchasing power of the private sector.

B. Increase private saving.

C. Correct inequities in the distribution of goods and services.

D. Transfer the command of resources from the private sector to the public sector.

Answer: D

You might also like to view...

Refer to Figure 8.2. Holding other variables constant, an increase in the real wage will result in a

A) movement from point A to point B. B) movement from point B to point A. C) shift from curve S1 to curve S2. D) shift from curve S2 to curve S1.

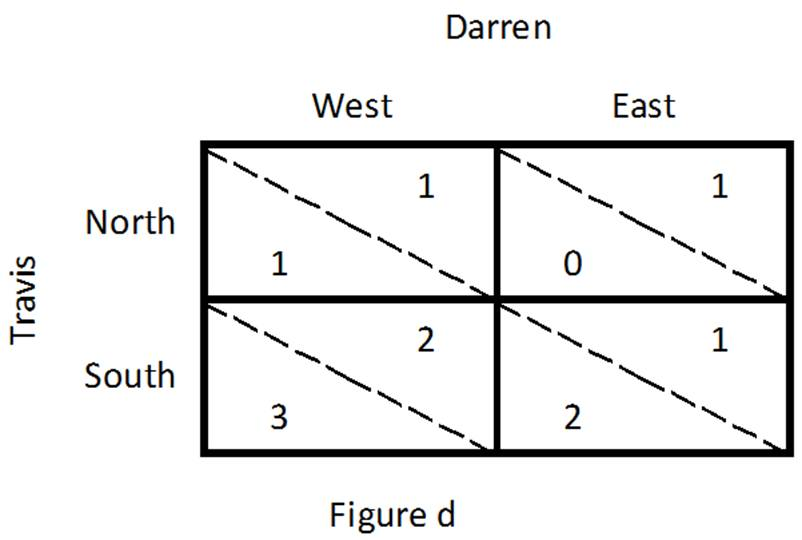

Refer to Figure d, which illustrates a game played by Travis and Darren. Travis's dominant strategy is:

A. North.

B. South.

C. East.

D. West.

When the average price level in the United States, relative to the average price levels in other countries, rises, this tends to

A. raise imports and exports. B. lower imports and exports. C. raise imports and lower exports. D. lower imports and raise exports.

In the case of the perfectly competitive firm:

A) marginal revenue equals the market price.

B) marginal revenue is greater than the market price.

C) marginal revenue is less than the market price.

D) marginal revenue is equal to, less than, or greater than market price depending on the level of output.