Suppose a new cost-saving device will forever generate $1,000 net savings per year to a firm. The device costs $10,000. Using the Internal Rate of Return approach, will the firm make the investment?

A) definitely

B) definitely not

C) if the interest rate exceeds 10%

D) if the interest rate is less than 10%

D

You might also like to view...

In the above figure, what is the amount of producer surplus at the efficient quantity?

A) $0 B) $1,000 C) $2,000 D) $4,000

In the balance-of-payments accounts, the statistical discrepancy

A) equals the capital account balance minus the current account balance. B) equals the current account balance minus the capital account balance. C) probably reflects hidden capital flows. D) must equal zero.

A new technology that increases labor productivity will shift the

a. demand curve for labor to the left b. MLC curve to the left c. MPP curve downward d. demand curve for labor to the right e. demand for the good to the right

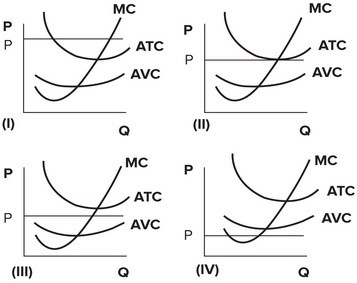

Refer to the following graphs. Which graph depicts a perfectly competitive firm that will minimize short-run losses by producing zero output?

Which graph depicts a perfectly competitive firm that will minimize short-run losses by producing zero output?

A. Graph I B. Graph II C. Graph III D. Graph IV