Marco Insurance acquired shares of Penny Systems' common stock on December 28, 2013, for $400,000 and classified them as trading securities. The fair value of these securities on December 31, 2013, was $402,000 . Marco Insurance sold these shares on January 3, 2014, for $405,000. (Refer to the Marco Insurance) The journal entries to record the sale of trading securities at a gain on January 3,

2014 .

a. Cash.................................................................405,000

Marketable Securities.................................................402,000

Realized Gain on Sale of Trading Securities.................3,000

b. Marketable Securities.................................... 402,000

Realized Gain on Sale of Trading Securities...... 3,000

Cash.......................................................................... 405,000

c. Cash.............................................................. 405,000

Marketable Securities................................................ 402,000

Unrealized Gain on Sale of Trading Securities............. 3,000

d. Marketable Securities.......................................402,000

Unrealized Gain on Sale of Trading Securities....3,000

Cash......................................................................... 405,000

e. Cash................................................................ 405,000

Marketable Securities.................................................402,000

Realized Gain on Sale of

Securities Held to Maturity........................................ 3,000

A

You might also like to view...

Promissory notes are non-negotiable

a. True b. False Indicate whether the statement is true or false

Rosemont Company began operations on January 1, Year 1, and on that date issued stock for $60,000 cash. In addition, Rosemont borrowed $50,000 cash from the local bank. The company provided services to its customers during Year 1 and received $35,000. It purchased land for $70,000. During the year, it paid $10,000 cash for salaries and $9,000 cash for supplies that were used up in its operations. Stockholders were paid cash dividends of $8,000 during the year.Required: a) List the transactions from the information above (for example, issued common stock for $60,000) and indicate in which section of the statement of cash flows each transaction would be reported.b) What would the amount be for net cash flows from operating activities?c) What would be the end-of-year balance for the cash

account? d) What would be the amount of the total assets for the Rosemont Company at the end of Year 1?e) What would be the end-of-year balance for the Retained Earnings account? What will be an ideal response?

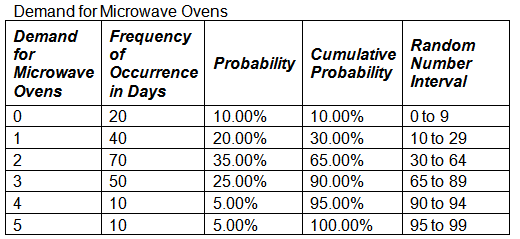

Consider the Demand for Microwave Ovens dataset. What is the total demand corresponding to random numbers 71, 63, 16, 9, 66, and 75?

a. 8

b. 9

c. 10

d. 12

An advantage of lease financing is the lack of an immediate large cash payment for the leased asset.

Answer the following statement true (T) or false (F)