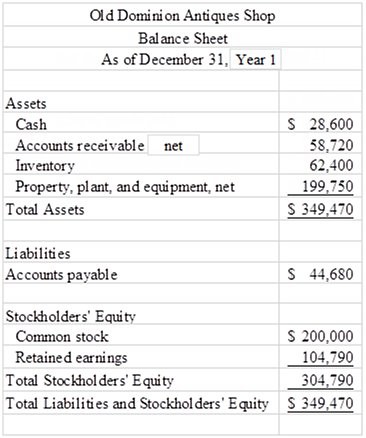

Old Dominion Antiques Shop reported the following income statement and balance sheet for Year 1:

During Year 1, the company's inventory turnover was 3.76 times and its average number of days to days to sell inventory was 97.1 days.Required:a) Determine the accounts receivable turnover ratio and the average number of days to collect accounts receivable.b) Determine the length of the operating cycle.(Round to one decimal place.)

During Year 1, the company's inventory turnover was 3.76 times and its average number of days to days to sell inventory was 97.1 days.Required:a) Determine the accounts receivable turnover ratio and the average number of days to collect accounts receivable.b) Determine the length of the operating cycle.(Round to one decimal place.)

What will be an ideal response?

a) 8.43 times and 43.3 days

b) 140.4 days

a) Accounts receivable turnover = Sales of $495,000 ÷ Net accounts receivable of $58,720 = 8.43 times

Average days to collect receivables = 365 ÷ 8.43 = 43.3 days

b) Operating cycle = Average number of days to collect receivables of 43.3 days + Average number of days to sell inventory of 97.1 days = 140.4 days

You might also like to view...

Which option for the treatment of missing values involves cases, or respondents, with any missing responses being discarded from the analysis?

A) returning to the field B) casewise deletion C) pairwise deletion D) substitute a neutral value

Total costs that change in direct proportion to changes in productive output, or any other volume measure, are called variable costs

Indicate whether the statement is true or false

Considering the residual value is zero, calculate the payback period. Round to one decimal place

Learn Safe Driving School is considering purchasing new autos costing $235,000. The company's management has estimated that the autos will generate cash inflows as follows: Year 1 $ 80,000 Year 2 $ 85,000 Year 3 $ 95,000 Year 4 $ 45,000

What are the four interrelated activities that together comprise a strategic workforce-planning (SWP) system?

What will be an ideal response?