The federal personal income tax

A. is actually less progressive than official tax schedules would indicate because of various tax exemptions and deductions.

B. has become extremely progressive as a result of taxpayers' being pushed into higher tax brackets by higher income levels.

C. has experienced substantial increases in rates during the past two years.

D. has a regressive structure.

Answer: A

You might also like to view...

Which of the following can result in a market producing an inefficient quantity of a good? i. competition ii. an external cost or an external benefit iii. a tax

A) i only B) iii only C) ii only D) ii and iii E) i and iii

The "old" Keynesian approach dominated macroeconomic theory until the

A) 1930s. B) late 1950s. C) late 1960s. D) early 1980s.

Management is the process of:

a. Controlling others' lives b. Using resources to achieve goals c. Changing one's perspective for the better d. Acting in a habitual or repetitive pattern

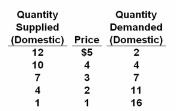

Refer to the given data. If the economy was opened to free trade and the world price of $1 prevailed, the price and quantity sold of this product would be:

Answer the question on the basis of the following domestic supply and demand schedules for a product. Suppose that the world price of the product is $1.

A. $1 and 1 unit.

B. $1 and 16 units.

C. $3 and 7 units.

D. $2 and 11 units.