According to the Ricardian equivalence proposition, a temporary government budget deficit created by cutting taxes

A. will cause future taxes to increase but will have no real economic effects.

B. will have the same real economic effects as a budget deficit created by raising government spending.

C. would have the same real effects whether or not consumers expect future taxes to change.

D. will cause desired consumption to increase.

Answer: A

You might also like to view...

Given the production function q = 4L + K, what is formula for the marginal product of labor?

A) 4 B) 4 + K C) 4K D) Cannot be determined with the information given.

According to the Taylor rule:

A. for every 1 percentage point that unemployment exceeds the natural rate of unemployment, there is a 2-percentage-point gap between potential and actual GDP. B. growth in the money supply should be limited to the long-run average growth rate of real GDP. C. if inflation rises by 1 percentage point above its target, then the Fed should raise the real federal funds rate by one-half a percentage point. D. the rate of money growth should be set at 4 percent per year.

Suppose that your college offers you two payment plans for your last two years of college. You may either pay tuition of $20,000 per year at the beginning of each of the next two years, or pay just $38,000 before the start of freshman year. What would the interest rate have to be for you to be indifferent between these two deals? Explain

What will be an ideal response?

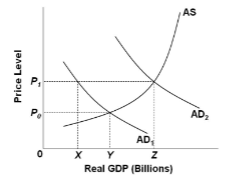

Refer to the figure. Suppose that the economy is currently operating at the intersection of AS and AD 2 , and that the full-employment level of output is Y. If contractionary fiscal policy and accompanying multiplier effects move aggregate demand from AD 2 to AD 1 , what will be the effect on real GDP and the price level?

A. Real GDP will fall to Y and the price level will fall to P 0 , assuming a ratchet effect occurs.

B. Real GDP will fall to X and the price level will remain unchanged, assuming a ratchet effect occurs.

C. Real GDP will fall to X and the price level will fall to P 0 , assuming a ratchet effect occurs.

D. Real GDP will fall to Y and the price level will remain unchanged, assuming a ratchet effect

occurs.