Consider an incumbent that is a monopoly currently earning $2 million annually. Given the declining costs of raw materials, the incumbent believes a new firm may enter the market. If successful, a new entrant would reduce the incumbent's profits to $1.2 million annually. To keep potential entrants out of the market, the incumbent lowers its price to the point where it is earning $1.6 million annually for the indefinite future. If the interest rate is 10 percent, does it make sense for the incumbent to limit price to prevent entry?

A. Yes, since $2 million > $200,000.

B. Yes, since $4 million > $400,000.

C. No, since $4 million > $400,000.

D. No, since $2 million > $200,000.

Answer: B

You might also like to view...

Suppose Mitsubishi Bank (a Japanese bank) expects the exchange rate to be 125 yen per U.S. dollar at the end of the year. If today's exchange rate is 120 yen per U.S. dollar, Mitsubishi bank

A) buys U.S. dollars today because it expects profit from buying U.S. dollars and holding them. B) sells U.S. dollars today because it expects losses from buying U.S. dollars and holding them. C) does not buy or sell any U.S. dollars today because it expects zero profit from buying U.S. dollars and holding them. D) None of the above answers is correct because a foreign commercial bank cannot buy or sell U.S. dollars.

What is an efficient tax system? What rules promote efficiency?

What will be an ideal response?

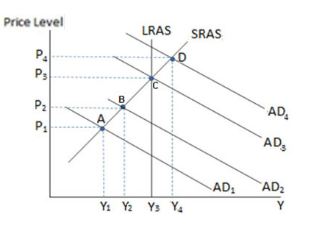

If the economy in the graph shown is at point D, and the government wished to bring the economy back to its long-run equilibrium, it might:

A. increase government spending.

B. decrease income taxes.

C. increase corporate income taxes.

D. All of these would bring the economy back to potential GDP.

Suppose you earn $4,800 a month and spend exactly $160 in each of the 30 days. If you deposit $1, 600 into your checking account on the first day, eleventh day, and twenty-first day of the month, then your average quantity of money demanded is

A) $800. B) $1,200. C) $2,400. D) $4,800.