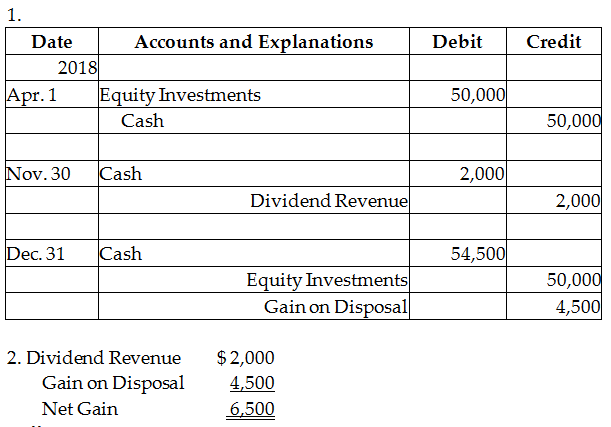

On April 1, 2018, Morton Company invests $50,000 in Johnson Company stock. Johnson pays Morton a $2,000 dividend on November 30, 2018. Morton sells the Johnson stock on December 31, 2018 for $54,500. Assume the investment is categorized as a short-term equity investment and that Morton does not have significant influence over Johnson.

Requirements:

1. Journalize the transactions for Morton's investment in Johnson's stock.

2. What was the net effect of the investment on Morton's net income for the year ended December 31, 2018.

You might also like to view...

The Clean Air Act (CAA) prevents businesses from buying and selling pollution allowances.

Answer the following statement true (T) or false (F)

Which Principle of the AICPA Code of Professional Conduct is: As a member one should continually strive to improve competence and the quality of services, observe all technical and ethical standards, and provide professional responsibility to the best of his/her ability?

A) The Public Interest B) Responsibilities C) Scope and Nature of Services D) Due Care

Explain why in any given season, the one-period decision model may result in a poor choice for a stocking level?

What will be an ideal response?

What tobacco company is known for its phenomenal atmosphere for diversity?

a. RJR b. Philip Morris c. Camel d. None of the above